Hey hey..

I love doing test! This article will be the first of many test-related article you will see in this blog. What I am going to do is to test my trading system (or you can call it

business plan) and see if the system will give positive return in the long term. I have experimented many system and this one will be experimented publicly! :)

With this, I am also testing myself (all of you are the judges) if I can follow strictly my rules and system. Please note that the

disclaimer page is here and my trading system may work for me but may not for you. Also, I have evolved into

a type of trader I am now, and pardon me if you are of different type and find this system does not suit you. :)

Let's start!

Trading System A (yes, you will see I am testing other systems)

#1. MISSION

I created this system so that I will have a POSITIVE return over long period of time (this test will be one year long!). Losing trades is part and parcel of this business, what matters the most is to have a positive return in the end. Note that I categorize this system as a trend following system and hence you will not see many trades in one year.

#2. GOALS

To trade right, strictly following my system and to minimize mistakes.

#3. RULES

My rules are here.

#4. METHOD

Step 1 -

Choose the market you would like to trade - Indonesia stocks

Step 2 -

Choose a bucket of stocks you would like to watch - I am using

online stock screener with fundamental analysis, which mostly include strictly good earning and sales growth. The following are the stocks screened as of today (1 Dec 2013). I will check this everyday as the watchlist can change whenever the criteria changes.

Step 3 -

Add the watchlist in your trading software. I am using Amibroker.

Step 4 -

Create a program/algorithm that will give me a buy and sell signal. To craft this algorithm, I spent hours/days/weeks to find out what combination of indicators that suits me. This system is for trend following and not very suitable to sideways markets. I have backtested it and give positive return if the signals are religiously followed and no slippage when you put order.

Step 5 - Everyday, I will

download EOD (free) for the Indonesia market (

contact me if you want to find out where to get). Upload the EOD to your software (Amibroker) and monitor daily (at most 15 minutes daily) if there are signals for all the stocks in your watchlist. Yup, I am only monitoring my watchlist, ignore the rest.

Step 6 - When signals BUY is given, quickly put an MARKET order, so you won't missed the boat. This is trend following system, so getting the order transacted is more important that what price you are getting. When signals SELL given, I will sell it 2 days after the signal is given.

Step 7 - Exit when there is a SELL signal or cutting loss at 10% drop from buying price

#5. MONEY

My capital allocated for this test is IDR 38,000,000. The size of lots I am buying will follow

my position sizing system.

#6. MIND

Psychology/Emotion is not really playing important part here as I am following buy/sell signal. But if you want to know how I manage my trading psychology, you can find my articles on

Psychology Trading.

#7. TRADING ROUTINES

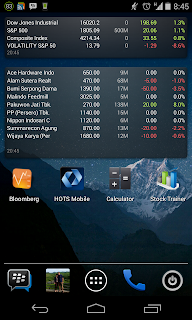

Explained in the METHOD part. You can make use of your

android smartphone to monitor your watchlist too.

#8. MISTAKES

Not yet committed :)

Wait for further update..