The scalper is an individual who makes dozens or hundreds of trades per day, trying to "scalp" a small profit from each trade by exploiting the bid-ask spread.

Momentum traders look for stocks moving significantly in one direction on high volume and try to jump on board to ride the momentum train to a desired profit. For example, Netflix (Nasdaq:NFLX) surged over 260% to $330 from January to October in 2013, which was way above its valuation. Its P/E ratio was above 400, while its competitors' were below 20. The price went up so high primarily because many momentum traders were trying to profit from the uptrend, which drove the price even higher. Even Reed Hasting, CEO of Netflix, admitted that Netflix is a momentum stock during a conference call in October 2013.

Technical traders are obsessed with charts and graphs, watching lines on stock or index graphs for signs of convergence or divergence that might indicate buy or sell signals.

Fundamentalists trade companies based on fundamental analysis, which examines corporate events such as actual or anticipated earnings reports, stock splits, reorganizations or acquisitions.

Swing traders are really fundamental traders who hold their positions longer than a single day. Most fundamentalists are actually swing traders, since changes in corporate fundamentals generally require several days or even weeks to produce a price movement sufficient enough for the trader to claim a reasonable profit.

Novice traders might experiment with each of these techniques, but they should ultimately settle on a single niche, matching their investing knowledge and experience with a style to which they feel they can devote further research, education and practice.

Source: http://www.investopedia.com/articles/trading/02/090302.asp

20131115

20131109

Books Recommendation on Stock Trading

For the past year, I have reading so many books (I didn't like to read a few years back). Some books I read are good, some aren't so good. Anyway the books that have gotten my attentions are listed below. Grab them in library or just buy them and keep them in your book shelf for your reference in the future.

#1. How I Made $2,000,000 in the Stock Market - Nicolas Darvas

"Hungarian by birth, Nicolas Darvas trained as an economist at the University of Budapest. Reluctant to remain in Hungary until either the Nazis or the Soviets took over, he fled at the age of 23 with a forged exit visa and fifty pounds sterling to stave off hunger in Istanbul, Turkey. During his off hours as a dancer, he read some 200 books on the market and the great speculators, spending as much as eight hours a day studying.Darvas invested his money into a couple of stocks that had been hitting their 52-week high. He was utterly surprised that the stocks continued to rise and subsequently sold them to make a large profit. His main source of stock selection was Barron's Magazine. At the age of 39, after accumulating his fortune, Darvas documented his techniques in the book, How I Made 2,000,000 in the Stock Market. The book describes his unique "Box System", which he used to buy and sell stocks. Darvas' book remains a classic stock market text to this day." (Amazon)

#2. Super Trader - van Tharp

"Super Trader provides a time-tested strategy for creating the conditions that allow you to reach levels of trading success you never thought possible. Providing expert insight into both trading practices and psychology, Tharp teaches you how to steadily cut losses short and meet your investment goals through the use of position sizing strategies--the keys to steady profitability." (Amazon)

#3. The Complete Turtle Trader - Michael Covel

"What happens when ordinary people are taught a system to make extraordinary money?Richard Dennis made a fortune on Wall Street by investing according to a few simple rules. Convinced that great trading was a skill that could be taught to anyone, he made a bet with his partner and ran a classified ad in the Wall Street Journal looking for novices to train. His recruits, later known as the Turtles, had anything but traditional Wall Street backgrounds; they included a professional blackjack player, a pianist, and a fantasy game designer. By the time the experiment ended, Dennis had made a hundred million dollars from his Turtles and created one killer Wall Street legend. In The Complete TurtleTrader, Michael W. Covel tells their riveting story with the first ever on-the-record interviews with individual Turtles. He shows how Dennis's rules worked—and can still work today—for any investor with the desire and commitment to learn from one of the greatest investing stories of all time" (Amazon)

#4. How to Make Money in Stocks - William O'Neil

"Through every type of market, William J. O’Neil’s national bestseller, How to Make Money in Stocks, has shown over 2 million investors the secrets to building wealth. O’Neil’s powerful CAN SLIM® Investing System—a proven 7-step process for minimizing risk and maximizing gains—has influenced generations of investors.

"So trading guru Richard Dennis reportedly said to his long-time friend William Eckhardt nearly 25 years ago. What started as a bet about whether great traders were born or made became a legendary trading experiment that, until now, has never been told in its entirety. Way of the Turtle reveals, for the first time, the reasons for the success of the secretive trading system used by the group known as the “Turtles.” Top-earning Turtle Curtis Faith lays bare the entire experiment, explaining how it was possible for Dennis and Eckhardt to recruit 23 ordinary people from all walks of life and train them to be extraordinary traders in just two weeks."

#6. Trading in the Zone - Mark Douglas

"Douglas uncovers the underlying reasons for lack of consistency and helps traders overcome the ingrained mental habits that cost them money. He takes on the myths of the market and exposes them one by one teaching traders to look beyond random outcomes, to understand the true realities of risk, and to be comfortable with the "probabilities" of market movement that governs all market speculation."

Happy reading!

20131103

6 Tips from Warren Buffet on Wealth Management

Who wouldn't know Warren Buffet, American businessman and investor who is also the CEO of Berkshire Hathway.

Known for his investing philosophy, many things can be learnt from Warren Buffet investment strategy and the way Mr Buffet manages his wealth. Below are money management advise from Warrent Buffet himself that I always remember whenever I am investing. So, like me, you can apply these 6 quotes on wealth management and apply to your daily investing experience.

#1 "Do not depend on a single income. Invest and create a second, third source of income"

I live by this quote on money management everyday. And you should too. While you are young (if you are!), start investing (or start with saving) now.

There are many ways you can invest. I personally start with stock investing (of course, you have to learn the proper way on how to buy stocks). If you have extra cash, buy a house or property. Two years ago, my wife and I bought a small apartment near our town, and it now sits in very nicely as the price have shots up and we are just waiting for acceptable valuation before selling it. I am also investing in mutual funds monthly for longer term plans. Other than that, you can always start your own business (be entrepreneur!). Gold investing may be an option too.

#2 "If you buy things you do not need, you may soon have to sell things you need"

Well, with limited assets (I mean money) coupled with unlimited "wants", life is always tough, isn't it? Well, manage you finance properly and start separate the "needs" and "wants", and be disciplined about it. This quote is one of the best of Warren Buffet saving tips.

#3 "Do not save what is left after spending, instead spend after you save/invest"

This is another favorite quote from Mr buffet I live by everyday (or rather every month after my payroll). I used to tell my wife, "Look, what I have by the end of this month is xxx because we spent xxx on this, this and that." It struck me hard that I have been all wrong. I should, instead, keep aside for savings/investment FIRST, then the rest are for my guilt-free spending. Now, I will always tell my wife,"I have allocated this, this, this and that for our savings/investments, this is what left and we can spend it, guilt-free!"

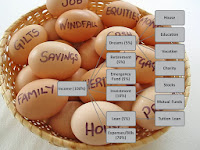

To give you better illustration, every time I got my salary banked in, I quickly get down to allocate some of my money for savings/investment (later you learn you can automate this)

(I invest more often now, more capital the merrier!)

#4 "Never test the depth of the river with both you feet"

To start investing (mutual fund, buy a stock, gold, est), start small! Start with 10% of you income (see above, I still use 10%) and if are more confident and your profit from investing is better, you can improve the percentage.

#5 "Do not put all eggs in one basket"

Diversification. Make your investment portfolio vary. Also, match you portfolio with your risk level.

#6 "Honesty is expensive, do not expect it from cheap people"

Just remember, people you meet are not all honest, and frankly not all people have the intention to be honest. Good adviser is hard to get, especially when it comes to wealth and money. So be careful in getting advise from people.

#1 "Do not depend on a single income. Invest and create a second, third source of income"

I live by this quote on money management everyday. And you should too. While you are young (if you are!), start investing (or start with saving) now.

There are many ways you can invest. I personally start with stock investing (of course, you have to learn the proper way on how to buy stocks). If you have extra cash, buy a house or property. Two years ago, my wife and I bought a small apartment near our town, and it now sits in very nicely as the price have shots up and we are just waiting for acceptable valuation before selling it. I am also investing in mutual funds monthly for longer term plans. Other than that, you can always start your own business (be entrepreneur!). Gold investing may be an option too.

#2 "If you buy things you do not need, you may soon have to sell things you need"

Well, with limited assets (I mean money) coupled with unlimited "wants", life is always tough, isn't it? Well, manage you finance properly and start separate the "needs" and "wants", and be disciplined about it. This quote is one of the best of Warren Buffet saving tips.

#3 "Do not save what is left after spending, instead spend after you save/invest"

This is another favorite quote from Mr buffet I live by everyday (or rather every month after my payroll). I used to tell my wife, "Look, what I have by the end of this month is xxx because we spent xxx on this, this and that." It struck me hard that I have been all wrong. I should, instead, keep aside for savings/investment FIRST, then the rest are for my guilt-free spending. Now, I will always tell my wife,"I have allocated this, this, this and that for our savings/investments, this is what left and we can spend it, guilt-free!"

To give you better illustration, every time I got my salary banked in, I quickly get down to allocate some of my money for savings/investment (later you learn you can automate this)

- 5% - DREAMS - for short term savings (for holiday at the end of the year)

- 5% - RETIREMENT - for long term savings (will only use the fund one year or more later)

- 5% - EMERGENCY FUND (just in case my boss starts to dislike me and I am out of job!)

- 10% - INVESTMENT (added to my broker account, mutual funds top-up, etc)

(I invest more often now, more capital the merrier!)

#4 "Never test the depth of the river with both you feet"

To start investing (mutual fund, buy a stock, gold, est), start small! Start with 10% of you income (see above, I still use 10%) and if are more confident and your profit from investing is better, you can improve the percentage.

#5 "Do not put all eggs in one basket"

Diversification. Make your investment portfolio vary. Also, match you portfolio with your risk level.

#6 "Honesty is expensive, do not expect it from cheap people"

Just remember, people you meet are not all honest, and frankly not all people have the intention to be honest. Good adviser is hard to get, especially when it comes to wealth and money. So be careful in getting advise from people.

Subscribe to:

Posts (Atom)