#1 "Do not depend on a single income. Invest and create a second, third source of income"

I live by this quote on money management everyday. And you should too. While you are young (if you are!), start investing (or start with saving) now.

There are many ways you can invest. I personally start with stock investing (of course, you have to learn the proper way on how to buy stocks). If you have extra cash, buy a house or property. Two years ago, my wife and I bought a small apartment near our town, and it now sits in very nicely as the price have shots up and we are just waiting for acceptable valuation before selling it. I am also investing in mutual funds monthly for longer term plans. Other than that, you can always start your own business (be entrepreneur!). Gold investing may be an option too.

#2 "If you buy things you do not need, you may soon have to sell things you need"

Well, with limited assets (I mean money) coupled with unlimited "wants", life is always tough, isn't it? Well, manage you finance properly and start separate the "needs" and "wants", and be disciplined about it. This quote is one of the best of Warren Buffet saving tips.

#3 "Do not save what is left after spending, instead spend after you save/invest"

This is another favorite quote from Mr buffet I live by everyday (or rather every month after my payroll). I used to tell my wife, "Look, what I have by the end of this month is xxx because we spent xxx on this, this and that." It struck me hard that I have been all wrong. I should, instead, keep aside for savings/investment FIRST, then the rest are for my guilt-free spending. Now, I will always tell my wife,"I have allocated this, this, this and that for our savings/investments, this is what left and we can spend it, guilt-free!"

To give you better illustration, every time I got my salary banked in, I quickly get down to allocate some of my money for savings/investment (later you learn you can automate this)

- 5% - DREAMS - for short term savings (for holiday at the end of the year)

- 5% - RETIREMENT - for long term savings (will only use the fund one year or more later)

- 5% - EMERGENCY FUND (just in case my boss starts to dislike me and I am out of job!)

- 10% - INVESTMENT (added to my broker account, mutual funds top-up, etc)

(I invest more often now, more capital the merrier!)

#4 "Never test the depth of the river with both you feet"

To start investing (mutual fund, buy a stock, gold, est), start small! Start with 10% of you income (see above, I still use 10%) and if are more confident and your profit from investing is better, you can improve the percentage.

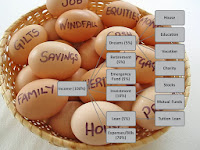

#5 "Do not put all eggs in one basket"

Diversification. Make your investment portfolio vary. Also, match you portfolio with your risk level.

#6 "Honesty is expensive, do not expect it from cheap people"

Just remember, people you meet are not all honest, and frankly not all people have the intention to be honest. Good adviser is hard to get, especially when it comes to wealth and money. So be careful in getting advise from people.

No comments:

Post a Comment